The quote to cash process in 10 steps

The quote-to-cash (Q2C) process is one of the most important business processes as it is responsible for driving revenue for the organization.

Simply put, the quote-to-cash process connects a customer’s intent to buy (the CRM) to a company’s realization of revenue (in the back-end ERP system), encompassing the entirety of your sales, contract, and customer relationship lifecycles.

Historically, these processes have been disconnected and siloed, often managed in multiple different files and systems, which leads to manual and inefficient sales cycles – ultimately putting what is important (the deals and customer experience) at risk.

By optimizing these highly collaborative aspects of your business, you bring visibility throughout your organization, speed up sales cycles, and close a higher percentage of your deals.

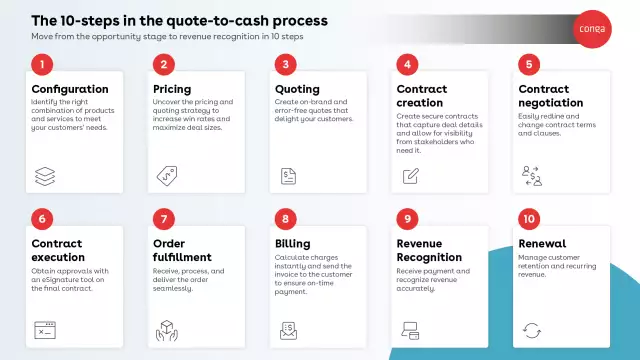

What is quote-to-cash? The 10-step guide

Here are the ten steps of the quote-to-cash cycle that can take you from the opportunity stage through revenue recognition:

- Configuration

- Pricing

- Quoting

- Contract Creation

- Contract negotiation

- Contract execution

- Order fulfillment

- Billing

- Revenue recognition

- Renewal

Configuration

The first stage in the quote-to-cash process is configuration where the goal is to identify the right combination of products and services to meet your customers’ needs.

In the modern business environment of increasing product and deal complexity, identifying the right combination of goods and services to recommend to the customer is essential to winning the deal. By automatically providing these recommendations to your sales reps, you can ensure that all your sales reps become configuration experts – and sell like the top 20%.

Pricing

During the pricing step, uncover the best pricing and quoting strategy to increase win rates and maximize deal sizes.

In the quote-to-cash world, pricing refers to the set of rules that dictate how sales professionals can best price a deal and what other incentives can be offered to customers. Identifying the right price for your products is only half the battle. Identifying the correct set of discounts, promotions, and incentives that win you the customer - without cutting into margins - is essential to driving revenue. By uncovering the pricing and promotion strategies that were successful in the past, sales reps can apply that winning strategy to future deals which leads to increasing win rate and maximizing deal size.

Quoting

With the quoting phase, your teams can create on-brand and error-free quotes that delight your customers.

Quotes are one of the most important steps in your sales cycle and often serves are your customer’s first impression with your business. While presenting a quick and accurate quote can win you a deal, an error-riddled and delayed quote can lose you a customer. To create the optimal customer experience, it is imperative that you present a quote quickly, while ensuring that it is error free and on-brand, all of which can be a difficult balance without automated solutions.

Contract creation

The next phase in the Q2C process is creating secure contracts that capture deal details and allow for visibility for all stakeholders who need it.

All deals end with an agreement that includes a set of agreed upon terms and conditions. These agreements can carry a lot of risk and can seriously impact your revenue streams. When it comes to protecting your business, the details matter. As contracts are created, it’s important that the right people have visibility into built-in clauses (renewal and termination clauses for example), the approval process, contract execution and renewals, and more to ensure your legal team is signing off on sound deals.

Contract negotiation

Contract terms and clauses are redlined and changed during the contract negotiation phase.

If you have ever been involved in a contract negotiation, you know it is a living, and constantly changing document, riddled with redlines and the need to track multiple different versions. Once you begin the contract negotiation phase, it’s critical to get detailed visibility into what is changing in your contracts as they go through multiple iterations. Automatically providing this information and visibility to your legal team can cut down on the needless tasks that waste the time of busy legal professionals.

Contract execution

Next up in the Q2C process is contract execution where you can obtain the approvals you need with an eSignature tool on the final contract.

A significant roadblock in many company’s sales cycles, effective contract execution, can slow down the revenue cycle and impact your time to revenue. But, by enabling an eSignature solution, you can drastically reduce the time spent obtaining signatures to finalize contracts. An effective eSignature tool can provide visibility into where the contract is in the process, current roadblocks, and which parties have yet to sign so you can plan your follow-ups accordingly.

Order fulfillment

During the order fulfillment stage of the quote-to-cash process, receive, process, and deliver the order seamlessly.

Once the contract has been signed, operations can jump into gear to ensure that the right products are delivered to the right customers in a timely manner. Having an automated and integrated system that provides visibility and one connected view of the customer’s journey can ensure that the changes to the order and requirements are reflected in the final delivery of the product. Having an end-to-end quote-to-cash solution will ensure that the agreed upon quotes, pricing, and contracting terms are communicated to the necessary parties, and connected to your ERP system.

Billing

Calculate charges instantly and send the invoice to the customer to ensure on-time payment during the billing phase of the Q2C process.

Accurate billing is critical to the success of your company, as it determines cash flow, allows for accurate forecasting, and revenue recognition. Billing is easy with a seamlessly integrated quote-to-cash process – everything captured in the quote (details such as discounts, billing timeframes, etc.) and in the contract are automatically passed on to your accounting team, which guarantees accurate billing and renewal information.

Revenue recognition

Receive payment and recognize revenue accurately.

Recognizing revenue incorrectly carries a lot of risk. When important details in your contracting terms—like pricing, net payment terms, and delivery schedules—are made available to your accounting department, your company will be more likely to recognize revenue correctly.

Renewal

The last phase of the quote-to-cash process is managing customer retention and recurring revenue.

Especially with the SaaS model, a large percentage of revenue comes in the form of repeat and subscription customers. This means that it is vital to stay on top of your contracts and know when your customers are up for renewals. With insights into your quotes, contracts, and renewal data, your business can effectively identify expiring contracts, upsell and cross-sell current customers, and reduce churn.

How to find an all-in-one quote to cash automation solution

Keeping track of each individual process, in different systems, is not only time-consuming, but it can result in vital information in the process being lost or completely forgotten. That’s why your business needs an end-to-end quote-to-case automation solution which will help your sales processes, allow for greater visibility from all the stakeholders involved, and improve your time to revenue.

When searching for a solution, keep these key elements in mind:

Save time creating documents with automated document generation software

Creating documents manually outside of your systems can be tedious. Plus, it increases the risk of data entry errors. If you are sending proposals, quotes, contracts, and other vital documents outside of your systems, you are losing visibility into where the document is in the process.

With solutions like Conga Composer, your teams can build fully customized, branded, and personalized documents quickly. What’s more, eliminate manual document tasks to reduce errors and result in better tracking and customer communication.

Increase visibility into the contract process with a contract lifecycle management solution

The contract process is vital and can prove to be complex and time consuming. Streamlining and automating this process is key in improving the revenue cycle while simultaneously maintaining control over contract terms and clauses so your legal team is signing off on good deals.

With Conga’s end-to-end contract management solutions, you can improve the customer and user experience while increasing visibility and speeding up sales cycle times, all while lowering risk for your company.

Streamline the quote to cash process with Conga’s end-to-end solutions

At the foundation of your quote-to-cash management process is automation. Automation makes it possible for teams to efficiently and accurately execute all the tasks required in the process. Solutions that streamline your team’s workflow, integrate seamlessly with your Salesforce CRM, all while providing a great customer experience will increase your time to revenue and have your teams working more efficiently.

Learn how revenue management solutions like Conga can help you navigate the Q2C process and effectively collect revenue, predict budgets, and efficiently manage billing and customer agreements.