5 ways to automate healthcare contract management

Free download

Automated and integrated process for healthcare organizations

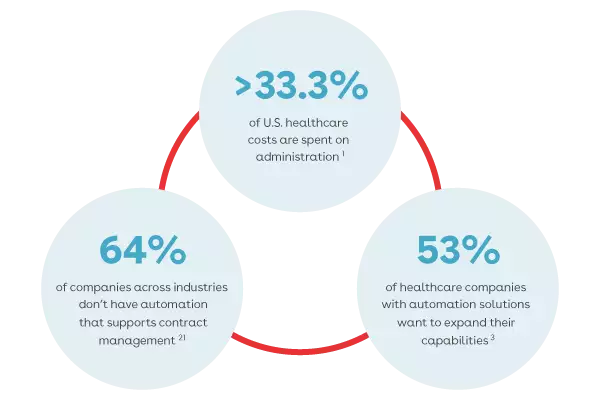

Today, 64% of companies lack the automation capabilities needed to support their contract management processes. The problem may be even more acute in healthcare, as many organizations are lagging behind the push for greater business process efficiency. As a result, they struggle with ineffective document and contract processes, disconnected tools and teams, and difficulties managing regulatory compliance and risk.

As the pressure mounts to improve operational efficiency and offer higher quality, consumer-focused care, healthcare organizations must respond. With integrated and automated contract processes, they have the opportunity to eliminate inefficiencies, achieve compliance, and improve relationships.

Navigating the everyday complexity of healthcare as a business

The healthcare and life sciences industries have always been sophisticated business ecosystems. They are made even more complex when we take into account changing regulations, new technology, and, most recently, the global pandemic. Legal and other teams working in this environment are entrusted with the weighty tasks of managing contracts, risk, compliance, and performance standards.

But many teams continue to rely on inefficient, manual, paper-based processes. As a result, they struggle with information silos, slow contract lifecycles, little to no visibility, and inconsistent legal language. In a fast-moving digital world, continuing to use these methods no longer serves healthcare organizations in any meaningful way.

It’s imperative for healthcare and life sciences organizations to find new, flexible ways to manage legal risk and stay compliant, while controlling costs. Organizations need end-to-end, automated solutions that speed up contract management, enable better collaboration across teams and systems, and maximize cost management. This will enable them to navigate an increasingly complex business landscape while freeing up resources to focus on delivering better patient care and outcomes.

Healthcare contract management challenges: Same old methods, subpar results

Even with the global push for greater efficiency across industries and sectors, many organizations in the healthcare industry lag behind when it comes to business process optimization. Without modern tools at hand, teams have to grapple with three key issues:

1. Inefficient document and contract processes

Manual processes require lots of time and effort, especially when it comes to creating and managing complex, multi-faceted contracts and agreements, such as those between payers and providers.

For example, Physician Participation Agreements and Business Associate Agreements (BAAs) contain a multitude of line items— like provider and service details, credentialing requirements, fee and reimbursement terms, rates obligations, and participating locations—that have to be filled in and updated.

A typical contract process also requires human intervention at every step. Usually, it involves someone in legal poring over each detail and revision before sending the document to the other party to be scrutinized, approved, and possibly changed again. But there’s no easy way for an administrator or other team member to make a change and update the contract in real time. Instead, any change requires sending it back to legal and starting the entire process again. There’s also no way to make mass changes to a large number of contracts or take similar bulk actions to improve efficiency.

Manually creating, amending, updating, approving, and managing these documents is not only time consuming and prone to error, but it’s also costly. This is precisely the type of expensive, inefficient approach that leads to industry-wide spend on administration.

2. Disconnected tools and teams, disrupted visibility

Nearly every organization has a contract creation and approval process, a procurement and ordering process, and an onboarding process. But it’s rare that these processes integrate and interconnect to synchronize and actually share information. This results in massive visibility gaps that increase the likelihood of errors, omissions, or contract delays.

For example, on the payer side, any time an insurance company onboards a new practice, business, partner, or physician, they have to manually replicate information by drawing data from different systems.

Even automation solutions can be disconnected from each other. An organization’s legal team may use a contract lifecycle management (CLM) tool, while the procurement team uses their own software platform, and sales uses a CRM. But no team has visibility into the other’s system, making it difficult to address friction or gaps in processes and reduce errors that occur during the contract lifecycle.

Without a centralized contract management tool, there’s no way to store contract terms and details as metadata, making it more difficult to extract and report on the data as well as integrate it with connected systems. This prevents providers and payers from accurately accessing what they need, when they need it, and hurts their ability to serve customers of those connected systems, resulting in disputes, additional manual work, and compromised customer and vendor experiences.

3. Difficulties managing legal and regulatory risk

Managing risk is a top priority in the healthcare industry, but how this translates to contracts and documents is often messy and confusing.

Healthcare organizations must strictly adhere to myriad laws, regulations, and industry standards, including HIPAA, the HITECH Act, the Affordable Care Act, JCAHO, GDPR, CCPA, the Sunshine Act, and the Stark Law. Compliance also requires a near-continual process of ensuring all clauses, terms, and obligations related to each law are standardized, updated and included for all documentation and processes, and that this occurs in the allotted time to meet critical deadlines.

But if there’s no centralized and templated system for teams to intelligently search for, update, and reuse clauses and other legal language, it’s much harder to mitigate risk and reduce liability.

5 ways to automate healthcare contract management

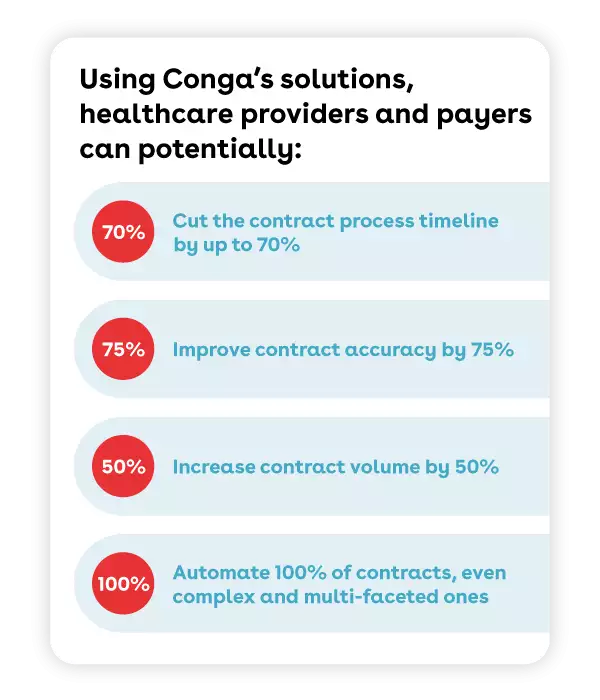

While every healthcare organization is different, they all share a similar need for efficiency, data integrity, and risk mitigation. Following are five aspects of healthcare contract management that can be automated with Conga’s solutions to better meet these critical needs.

1. Force Majeure clause detection and management: In the wake of the pandemic, Force Majeure clauses have taken on new meaning. Conga’s solutions allow healthcare organizations to build and update these clauses within contracts to protect against sudden, unforeseen disruptions and loss of business, should another health crisis or similar widespread emergency appear again.

2. Performance management: Provider service agreements contain performance standards and obligations and milestones which often trigger fee disbursements. Conga’s solutions enable greater visibility into and control over agreement obligations and performance criteria so providers can be driven to meet their contractual obligations and get reimbursed.

3. Risk management: Risk can live anywhere, especially when error-prone humans and manual effort are involved. Through template standardization and risk language detection, Conga’s automated solutions help organizations find, mitigate, and reduce risk across document processes and throughout the contract lifecycle to avoid costly compliance and other business issues.

4. Data integrity management: With any number of software systems and technology tools in play at any given time, it’s difficult for teams to find and access the data they need, while also avoiding data duplication and corruption. Instead of hunting in multiple locations, Conga’s solutions help to maintain a single source of truth that enables healthcare organizations to integrate with and access data across systems, making it easier for key teams to use and share essential information.

5. Process automation: The demand to improve efficiency in healthcare will only continue to increase. Conga’s solutions automate critical processes and workflows to keep up with the industry’s movement toward digital tools and lower operational costs. Enabling mass creation and updating of provider agreements, for example, significantly improves administrative efficiency and helps decrease spend.

Contract management benefits: Greater efficiency, visibility, and control

A CLM solution like Conga that seamlessly integrates with related solutions—such as approvals and electronic signature, plus a CRM like Salesforce—is particularly helpful in overcoming the challenges of healthcare contracting. It can break down silos across departments and create a more cohesive data model that results in greater efficiency, accuracy, and visibility for all teams that touch contracts within an organization.

Conga’s solutions enable healthcare organizations to effectively gain control over and manage previously burdensome onboarding, contracting, and other documentation processes. Using a single, automated, up-to-date source of truth, payers and providers can manage vendor and customer relationships, performance, and contractual obligations while ensuring legal and regulatory compliance.

Conga’s contract lifecycle management solutions enable payers and providers at any stage of maturity to:

- Accelerate all contract processes, including changes and approvals, eliminate tedious tasks, and use self-service capabilities to improve overall contract efficiency

- Collaborate and negotiate rapidly using online comments and redlining

- Manage templates and clause libraries to ensure formatting and language consistency

- Ensure data accuracy across all systems, including claims, payments, and eligibility verification systems, and connect teams to the same real-time information

- Deliver a smoother onboarding and engagement experience that increases provider satisfaction

- Streamline collaboration between internal and external stakeholders to enable more effective provider relationships and vendor performance management

- Facilitate better risk management and ensure legal and regulatory compliance, including for emerging and changing regulations

- Search contracts and detect provisions and terms to prepare for uncertain events

- Track KPIs and gain insight into cycle times, clause usage, contract value, and more

- Do all of this from a secure, cloud-based platform with point-and-click configuration—making it possible to include tasks, approvals, automation, and guided experiences as parts of the process

Connect and simplify healthcare business processes

When critical business processes—such as onboarding, credentialing, relationship management, contract lifecycle management, rate management, and compliance—are integrated and streamlined, teams eliminate manual effort and tedious workflows. Conga’s solutions replace inefficient, traditional processes for healthcare operations management with a suite of powerful tools and capabilities that speed up cycle times, improve visibility and control, and ensure compliance.

Just as important, healthcare organizations are able to redirect key resources to improve productivity and prioritize quality patient care—all of which are reflected in the bottom line. By adopting end-to-end, automated contract lifecycle management solutions, healthcare organizations are positioned to grow and adapt to industry, market, and regulatory changes.

To learn more about Conga’s solutions and how your organization can optimize and automate contract lifecycle management, schedule a demo today.

Free download