Gain the flexibility to invoice and bill at customers’ request

Grow your revenue by providing multiple billing models for any product offering, including subscriptions and professional services—all on one invoice

31% improved invoice accuracy with automated billing

Simplify your billing and invoicing process

I’m losing customers due to multiple invoices being sent for a single order. What do I do?

Create single, consolidated invoices for complex orders with Conga’s flexible invoicing options.

How do I reduce the time spent on manual tasks, such as data entry and invoice generation?

Automate manual tasks, such as invoice generation, calculations, and data entry with Conga Billing.

How do I integrate custom billing and pricing models without extensive customization?

Conga supports various billing models and custom pricing structures, such as subscriptions and more.

How do I keep track of revenue trends, customer behavior, and financial performance?

Generate customized reports and dashboards for valuable insights into your revenue-generating activities.

Gain a revenue advantage with our flexible billing management software

Tailor your billing experience

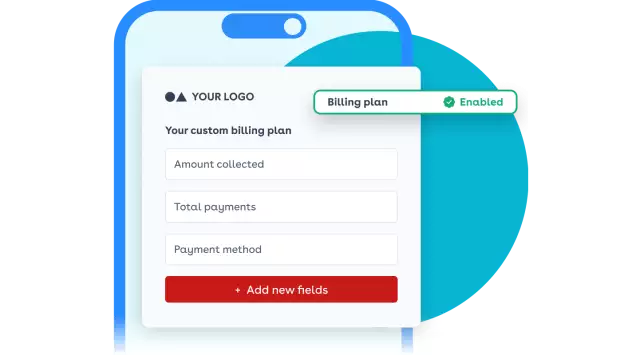

Create custom billing plans

Design unique billing plans to suit your specific business models and customer preferences, such as tiered pricing, usage-based billing, or subscription plans.

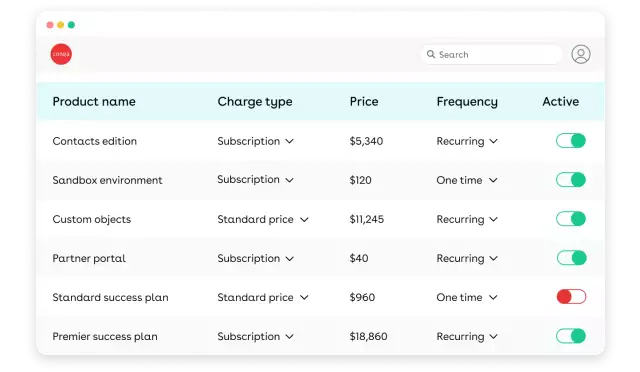

Invoice and bill for a blend of business models

Easily generate invoices for complex transactions, including subscriptions, one-time purchases, and professional services, ensuring accurate billing and customer satisfaction.

Manage subscriptions

Manage subscription terms and renewals

Effortlessly manage subscription terms, renewals, and changes for accurate billing.

Automate subscription adjustments

Adjust billing schedules based on upgrades, downgrades, or swaps—automatically—reducing manual processes and errors.

Optimize billing for projects

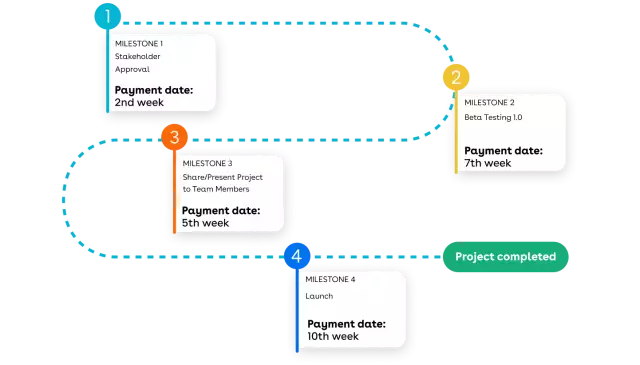

Set up milestone billing

Accurately track and bill for project-based work using milestone payments, ensuring timely invoicing.

Customize project billing schedules

Invoice and bill on different due dates to align with project timelines and payment terms, providing flexibility and control.

Gain comprehensive visibility

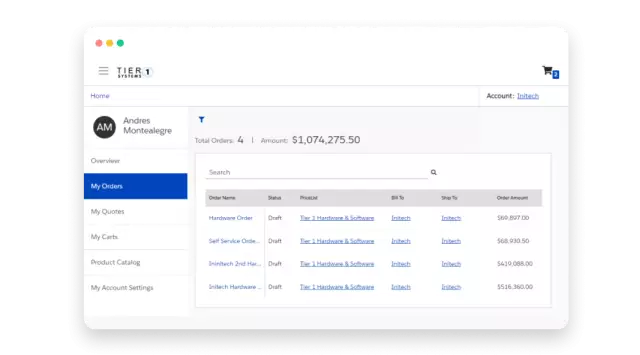

Access a single view of orders

Get a clear overview of your orders, including details, status, and history from a centralized dashboard.

Track billing history and performance

Monitor key billing metrics, identify trends, and make data-driven decisions to optimize your billing processes in real time.

Connect seamlessly

Link with existing systems

Conga Billing seamlessly integrates with your ERP, CRM, and accounting systems, streamlining workflows and eliminating data silos.

Customize integrations to meet specific needs

Conga supports your unique business invoicing needs—no matter the complexity.

Improve efficiency and accuracy

Reduce manual errors and save time

Conga Billing's invoicing automation capabilities minimize manual data entry and reduce the risk of errors, improving overall efficiency and accuracy.

Streamline billing processes

Automate invoice generation, scheduling, and adjustments to reduce manual tasks and ensure timely billing.

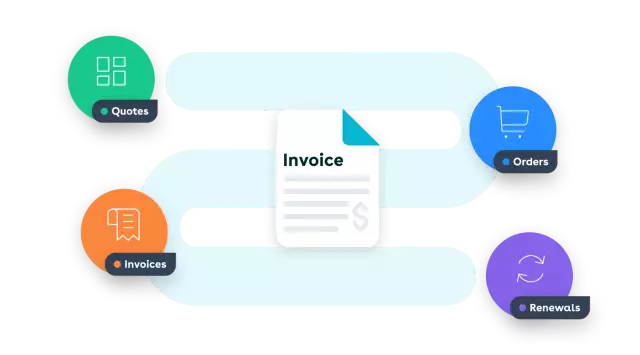

Billing requires more than sending out an invoice

Billing is just one stage of your quote-to-cash to renewal process. Automate your entire revenue lifecycle to streamline your QTC workflows. Here’s how:

Automate invoicing

Create automated invoices for orders configured in Conga CPQ, ensuring accurate and up-to-date invoices.

Generate accurate invoices

Use Conga Composer to generate invoices, automatically populating documents with relevant data.

Share invoices for eSigns

Send invoices for approvals and signatures right from your existing CRM.

Keep invoices up-to-date

Ensure accurate billing and invoices by pulling data from contracts. Update pricing and negotiate as needed.

Proven results in improved cash flow

You’ll be in great company. See how our customers achieved invoicing accuracy with our billing automation software.

Invoice accuracy improved

Forecast accuracy improved

Order-to-cash cycle speed increased

Ready to streamline your invoice management?

Offer more billing options to your customers and keep up with changing revenue models. See how Conga Billing improves your customer relationships.

Frequently asked questions

-

What is billing and invoicing software?

Billing and invoicing software is a tool that helps businesses manage their financial transactions, specifically related to billing and invoicing. The software automates many of the time-consuming manual tasks, such as creating invoices, tracking payments, and managing customer accounts.

-

Can I create custom billing per customer?

Yes, you can create custom billing plans per account to invoice your customers based on their preferred payment methods, including:

- Recurring payments: Set up recurring billing schedules for subscription-based products or services.

- One-time payments: Process one-time payments for products or services purchased on a non-recurring basis.

- Milestone payments: Establish milestone-based payments for projects with specific deliverables or phases.

- Percentage-based payments: Calculate payments based on a percentage of a project's total value or a specific metric.

- Custom payment terms: Offer flexible payment terms, such as net 30, net 60, or early payment discounts, to accommodate different customer preferences.

-

Which software is best for invoicing?

The best invoicing software depends on your specific business needs and preferences. To find the best software for your business, consider factors like:

- Features: What features do you need, such as recurring billing, expense tracking, or payment processing?

- Cost: What is your budget for invoicing software?

- Ease of use: How user-friendly is the software?

- Customer support: Does the provider offer reliable customer support?

By carefully evaluating these factors, you can choose the invoicing software that best suits your business. Conga Billing is a leading solution that offers all these features (and more) or can easily integrate to any ERP.

-

How can Conga Billing streamline invoices?

Conga Billing streamlines your invoicing process by allowing you to provide mixed billing options on a single invoice. You don’t have to create multiple invoices to accommodate different billing types, such as one-time, non-recurring, usage-based, subscription-based, and more. You can include all—on a single invoice.

-

Can I bill for orders configured in Conga CPQ?

Yes. Conga Billing integrates with Conga CPQ and automatically generates invoice schedules from the order, reducing manual efforts and increasing team productivity.

-

Does Conga Billing support subscription orders?

Yes. Conga Billing offers flexible subscription billing options, including schedules and automated renewal alerts, revised billing after configuration changes, swapping items, or terminating order portions.