What is AI for contract management?

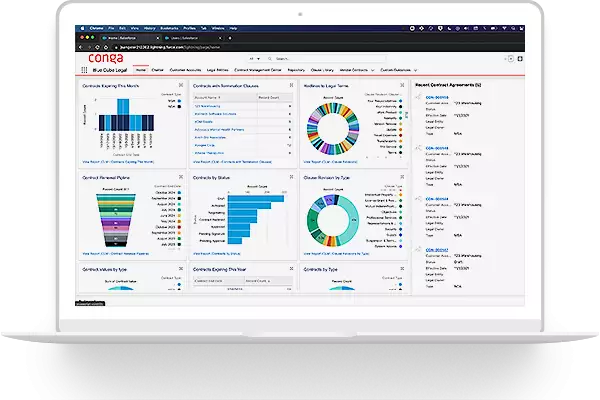

Empower teams to identify and capitalize on each and every revenue opportunity with Conga’s suite of intelligent, AI-powered contract management solutions that get everyone on the same page.

Free download

Executive Summary | Maximize contract value with AI

Business growth and scalability come from being able to identify and capitalize on each and every revenue opportunity.

But when neither legal nor sales teams have a comprehensive, accurate understanding of all existing contracts or obligations, the potential is high to disappoint customers and miss contract renewals. Manually finding key information to understand overall account health and details like upcoming obligations or renewal dates is a time-consuming process with uncertain results.

Conga’s suite of intelligent, AI-powered contract management solutions for legal teams eliminates manual contract organization and management. Legal teams are freed from having to hunt down and update contract terms, enabling sales to manage renewals and other post-signature processes on their own. Legal continues to control risk while giving organizations the ability to fully and strategically leverage their own contracts.

The challenges today’s legal teams face

Outdated contract storage

Many businesses have evolved from traditional file cabinets to some kind of digital repository for housing and managing contracts. But these tools are only glorified storage systems and haven’t freed legal and other teams from manual organization, categorization, and search. It remains difficult to see the full extent of the organization’s obligations and terms or to answer critical business questions.

Sorting through a variety of file types is a challenge, especially for legacy contracts, which often exist in older formats. Because contracts can live in multiple systems and come from multiple sources, it’s nearly impossible to aggregate them, let alone enable non-legal teams to answer their own questions or find relevant terms.

Lack of post-signature visibility

Without an automated process for extracting date-related terms, manual contract annotation typically falls through the cracks or remains in a perpetually in-progress workflow status, making your critical contract data forever an incomplete dataset. With this limited visibility into existing contracts, it’s much harder for sales to manage the renewal process effectively. If your legal team is still in a state of manual contract annotation, then it’s much less likely that your CRM is programmed to notify sales of an upcoming renewal. Reaching out to the customer proactively becomes an afterthought, as it’s too easy to miss expiration dates—and to subsequently miss out on recurring revenue.

If an organization happens to have an auto-renewal system in place, there’s still a strong chance that some contracts will renew without sales even knowing about it. They can’t intervene in time, leading to more missed opportunities to assess account health and make recommendations that capture additional revenue.

Difficulty managing change

A manual contract data management process and inaccurate contract categorization leads to other downstream reactive processes creating sudden and unpredictable urgency for the legal team. Legal has to drop what they’re doing to help sales find contracts, update terms, answer questions, or rewrite the contract from the ground up. This makes it difficult for legal teams to work efficiently on a high volume of contracts or have enough time to focus on other critical demands, like developing proactive policies to protect the business.

Conga’s contract management solutions streamline and speed up revenue cycles

Conga’s contract solutions are powered by best-in-class AI models, which help you reduce the manual steps needed to manage a contract database. It frees legal teams from constant interruptions and allows them to be more productive and strategic. With the right contract management system, legal teams help sales to be more proactive and the business to become more profitable.

Conga’s integrated platform of solutions enables legal teams to:

Save time and legal overhead

The advanced, AI-powered platform easily stores and categorizes contracts, clauses, and related documents, however large or complex, across all sources and file types—including PDFs, TFFs, Microsoft Word docs, and more. Users can also easily and intuitively search for virtually any file type using common terms or terms specific to business needs. The platform enables legal to better understand the terms, conditions, and inclusions of signed contracts for more comprehensive insights and business analyses.

Empower sales teams

Conga’s platform gives sales the insights and tools they need to manage post-signature processes and opportunities, such as renewals, without having to involve legal at every turn. Sales can proactively manage contract cycles and gain clear visibility into contract expiration dates—without manual annotation.

The AI tool extracts date-, clause-, and accompanying contract- related terms from each contract and populates them in the CRM, notifying sales of upcoming expiration dates and reducing the worry that something will be missed. Sales has the time they need to proactively touch base with customers, identify new revenue opportunities, and consult with legal, when necessary, on contract changes or updates—without having to do so last minute.

Accessible, accurate contract information for greater contract value

Conga’s contract solutions ensure sales and other teams have the tools and freedom they need to earn the greatest value from their contracts while legal retains control over contract management.

When Lucidchart implemented Conga’s solutions, the company left their inefficient, de-centralized contract management system behind in favor of a single, streamlined, data-rich platform. Legal kicked off their onboarding process with a bulk upload of 500 contracts, immediately providing deep visibility into their upcoming obligations. Any user, regardless of team, can quickly find accurate contract information on their own at any stage of the contract lifecycle. With effective contract processes, the company is now positioned to better scale and grow, handling hundreds of customer and vendor agreements a month.

With an AI-powered contract management system, legal elevates as a strategic team in driving revenue. By improving contract management, Conga’s solutions allow you to maximize contract value and empower your employees across all teams in the revenue operations process.

To learn more about Conga’s contract lifecycle management solutions, schedule a demo today.

Free download