Banking master class: part one

Today’s banking industry is highly competitive. Online startups and digital-native banks present a true challenge to once-dominant traditional institutions, and customer expectations of speed and access continue to evolve. Banks and credit unions must be innovative and progressive to stay relevant in the digital age of banking—so it’s more important than ever to adopt automation capabilities that can help streamline workflows, eliminate roadblocks, and increase efficiency.

To explore this topic in more detail, Conga Product Marketing Manager Brad Brochocki recently led a Banking Master Class webinar, How to gain a Revenue Advantage through automation. Following are some key takeaways from this important discussion.

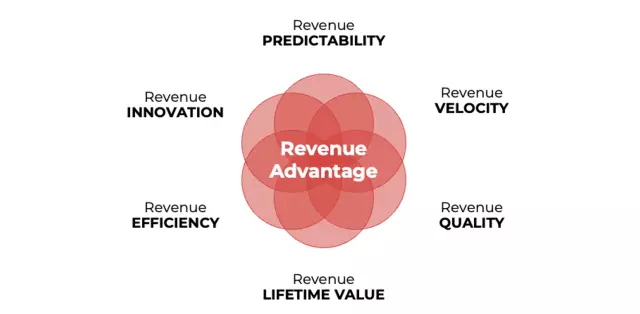

The 6 dimensions of Conga’s Revenue Advantage

Conga accelerates the end-to-end revenue lifecycle by automating repetitive and time-consuming processes, to help our customers gain a Revenue Advantage. What do we mean by that? There are essentially six key dimensions that Conga solutions deliver, which come together to create the Revenue Advantage:

- Revenue predictability: Having a reliable understanding of when revenue will be coming in from your customers and prospects

- Revenue velocity: Accelerating the speed at which you bring in revenue by automating various processes

- Revenue quality: Delivering the right information to the right people at the right time to power better decision making

- Revenue lifetime value: Increasing the lifetime revenue from your customers by creating repeatable processes

- Revenue efficiency: Reducing the time to revenue

- Revenue innovation: Leading the way with new and unique ways of engaging with your customers

Any company can automate processes to gain a Revenue Advantage, but often banks and credit unions don’t know where to start. The answer may be different for every financial institution, depending on factors like size, strategic objectives, and more. Two Conga customers joined our webinar to share their perspective on this issue.

“The second is lifetime value, which is critical to us because we’re in the agricultural industry—which is a lifelong business. You grow up in farming, you live your life in farming. So maximizing those lifetime relationships is a high priority,” said Doug Richards, SVP and CTO at Cooperative Finance Associates (CFA).

“As a small financial advisory firm, it’s not unusual to have meetings around a kitchen table with three generations of the same family who all work with our company. Serving those lifelong relationships is really important—which equates to lifetime value in Conga-ese,” said Preston Pellegrini, Associate at Pellegrini Financial. “Along with that comes the need to look inward to our own processes to create more efficiency. Our customers are like family, so the last thing we want is to slow down the process and make them feel like they’re not valued. We’re always looking to free up advisors’ time and unlock that efficiency to better serve our clients.”

Avoiding the Revenue Friction Zone

As companies begin to move away from the status quo and embrace automation, we’ve observed that they struggle to make the transition. We call this roadblock the Revenue Friction Zone, and it can be caused by a variety of issues like:

- Isolated or non-integrated technology

- Fragmented data

- Unidentified contract risk

- Large, disconnected functional teams

- Siloed problem solving

- Poor buyer experiences

Our webinar guests shared their experience with revenue friction.

Identifying revenue friction zones is critical in the banking industry, because successful process automation can have a real impact on the bottom line—including higher win rate, increased sales revenue, and so much more. Watch the recording for more insight to help uncover friction zones in your own banking organization.

Becoming a Revenue Growth Champion

As banks and credit unions make the transition to automated revenue processes, they rid themselves of manual work and simple human error—leading to incredible business results like these:

- 23% increase in sales revenue

- 27% increase per renewal

- 25% improvement in win rate

- 26% faster cash cycle

- 25% decrease in contract processing time

We call Conga customers who achieve these impressive gains our Revenue Growth Champions. Both CFA and Pellegrini Financial have achieved Revenue Growth Champion status, and they were happy to share some of the results from their automation journey.

CFA: One of CFA’s primary automation objectives was replacing a 20-year-old legacy system that had been put in place to electronically replicate manual paper processes. Implementing automated document generation within their lending process allowed CFA to streamline customer communications, easily generate large volumes of proposals, and automate proposal pricing details—resulting in:

- Instant generation of key reports that previously took 24-48 hours

- Dramatic growth in asset portfolio, directly correlated with digitizing customer relationships and removing process complexity through automation

Pellegrini Financial: Pellegrini customers tend to be less tech-oriented, so reports and financial plans are often still delivered in paper form. So their automation efforts have been more focused on internal processes to streamline data and deliver those reports as efficiently as possible. Using Conga solutions allows them to leverage their CRM data in new ways, generating large quantities of branded documents with the click of a button. Quantitative results include:

- More than 55 working days saved per year

- Over $71,000 in cost savings annually

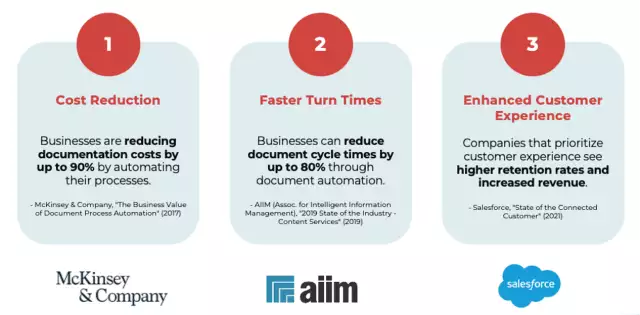

Top 3 benefits of document automation

Regardless of your institution’s priorities or the specific ways in which you use apply document automation, there are three key benefits that are designed to improve ROI:

- Cost reduction: According to McKinsey, businesses are reducing documentation costs by up to 90% by automating their processes.

- Faster turn times: The Association for Intelligent Information Management found that businesses can reduce cycle times by up to 80% through document automation.

- Enhanced customer experience: As the Salesforce State of the Connected Customer report stated, companies that prioritize customer experience see higher retention rates and increased revenue.

Understanding your document automation maturity

As companies embrace automation and streamline their revenue lifecycle, they progress to new levels of automation maturity. It’s important to understand where your organization sits on the document automation maturity spectrum—and how to continue progressing.

Our webinar concluded with a live demo that illustrates each level in this maturity model, along with clear definitions and real-life examples for each. Watch the recording and learn how to assess automation maturity in your own organization.

Start your automation journey

Ready to learn more about the Conga Revenue Advantage and how it can transform your business operations? Check out our Revenue Advantage Roadmap for an easy visual explanation, then get a free demo to see our document automation solutions in action.